If you need a loan that is going to make a change in your life, a Nedbank Online Personal Loan might be for you. Do you need money for a forthcoming event or for making a large purchase that you can repay with ease? By availing of the Nedbank Online Personal Loan, you have a company by your side that you can go to for this kind of financial service.

As a leading bank in South Africa, Nedbank provides a full suite of services to help you achieve your dreams. There are a variety of reasons why you might be in the need of a personal loan, but your end goal is more important. There are many loan options on the market, so there is surely one that is fit for you. The key to it all is to consider want to bring to your financial lifestyle.

You should look into things like interest rates, payback terms, as well as special perks you can't get anywhere else. Our editors have examined the Nedbank Online Personal Loan to get important details for you. Make sure you read all the information provided below before you decide whether or not this loan is right for you.

What Are the Benefits of a Nedbank Online Personal Loan?

With the Nedbank Online Personal Loan, you can renovate your home, book flight and hotel accommodations with your family, and host big events such as weddings. You can also use your loan to consolidate credit card debts and keep your finances in order

You can also get a detailed itemization of the fees you should pay with the help of Nedbank's advanced online application resources, such as Personal Loan Calculator and bank statements. With Nedbank's extensive repayment period — spanning from six to 72 months — you have a better option to settle what you owe to the bank with flexibility and convenience.

You are also entitled to the bank's Nedbank Personal Loan Protection Insurance, which allows its customers to enjoy coverage that will protect their family from settling the remaining balance in the event of their untimely demise, disability, and retrenchment.

Are you excited about getting a Nedbank Online Personal Loan? Here are the requirements and the application process of the bank.

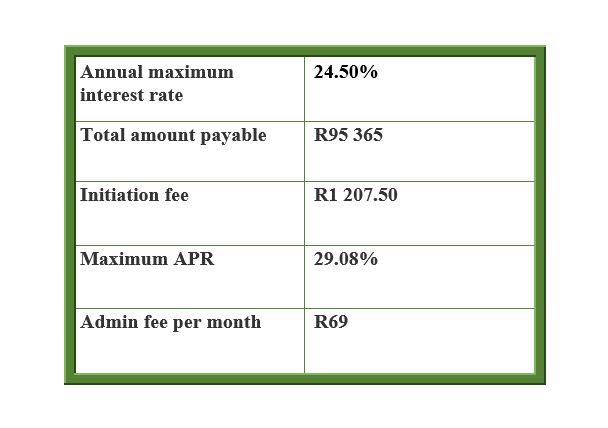

What Are the Fees for the Nedbank Loan?

This loan product, like many others, has certain fees that you should be mindful of. The representative loan term with Nedbank is considered to be R50 000 borrowed over 60 months.

Being aware of the limitations and fees associated with a loan product is essential in your path to steering clear from long-term debts. Let's take a look at some of the associated fees below.

The annual interest rate that you should pay for Nedbank Online Personal Loan is averaged at 24.50%, but in the end, your personal interest will be based on your creditworthiness, financial condition, and other factors.

In summary, the Nedbank Online Personal Loan will allow you to get additional cash you need for making large purchases and other major events for your family that you can repay in easy and flexible terms.

How to Get a Nedbank Online Personal Loan

You can request a Nedbank Online Personal Loan by visiting the Nedbank website and filling out an online form. A loan specialist from Nedbank will process your application and may call you back to ask request for other information and requirements.

The bank requires its borrowers to present a valid ID or other supporting documents showing you are at least 18 years old. You should also present proofs that you are a South African citizen or permanent resident and earning ZAR3,500 as a net monthly salary through a bank account.

You can loan from ZAR2,000 to ZAR300,000 that you can repay for 6 to 72 months. Once the bank approves your application, you will receive your loaned money from the bank account you provided. You can also allow Nedbank to deduct the loan balance from your bank account for the repayment of your loan.

How to Contact Nedbank

Nedbank's head office address is 135 Rivonia Road, Sandown, 2196 Sandton, South Africa. To get in touch with Nedbank via telephone, call 0860 103 582.

Conclusion

When it comes to choosing a South African personal loan, there are many factors to consider. By borrowing from Nedbank, you get the convenience of an extensive repayment period, the chance to consolidate credit card debt, and more.

However, you also may face a pricey APR in the long run. These are all aspects to consider when choosing whether you will apply online for a Nedbank Personal Loan. Start considering your options today!

Note: There are risks involved when applying for and using a loan. Consult the bank’s terms and conditions page for more information.